sacramento county tax rate 2021

Whether you are already a resident or just considering moving to Sacramento to live or invest in real estate estimate local property tax rates and learn how real estate tax works. This includes Secured and Unsecured supplemental escaped additional and.

Services Rates City Of Sacramento

450 N STREET SACRAMENTO CALIFORNIA.

. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. 2021-2022 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00249 los rios coll gob 00249 los rios coll gob 00249 sacto unified gob 00918 sacto unified gob 00918 sacto unified gob 00918. The minimum combined 2022 sales tax rate for Sacramento County California is.

2021-22 CALIFORNIA CONSUMER PRICE INDEX Revenue and Taxation Code section 51 provides that base year values determined under. A county-wide sales tax rate of 025 is applicable to localities in Sacramento County in addition to the 6 California sales tax. PO BOX 942879 SACRAMENTO CALIFORNIA 94279-0064.

Tax rate Tax amount. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700.

The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375. To review these changes visit our state-by-state guide. The estimated 2022 sales tax rate for 95821 is.

The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. The Sacramento County sales tax rate is. The California state sales tax rate is currently.

Has impacted many state nexus laws and sales tax collection requirements. County Sacramento The documentary transfer tax is based on the rate of 55 of each 500 or fraction. Increase in Assessed Values for Sacramento County 519 532 539 Total Number of Secured Assessments 484604 Total Number of Unsecured Assessments 32803 Total Assessments 517407.

Lowest sales tax 725 Highest sales tax 1075 California Sales Tax. Identify the total amount of your state county city transfer tax. 1788 rows Sacramento.

This is the total of state and county sales tax rates. Jurisdiction 2021-22 2020-21 Net Increase Increase. Method to calculate Sacramento County sales tax in 2021 As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Sacramento County California Sales Tax Rate 2022 Up to 875. The December 2020 total local sales tax rate was also 7750. 775 Is this data incorrect The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc.

Into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property hamilton county property tax records hamilton county search for hamilton county oh property tax records property tax records include property tax payments tax liens defaults on property taxes how to. The Sacramento County Sales Tax is 025. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax.

Hamilton County Ohio Real Estate Tax Bills. The most recent secured annual property tax bill and direct levy information is available online along with any bill s issued andor due in the most recent fiscal tax year through e-Prop-Tax Sacramento Countys Online Property Tax Information system. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of.

To calculate the amount of transfer tax you owe simply use the following formula. Property information and maps are available for review using the Parcel Viewer Application. Sales Tax Calculator of Sacramento for 2021 The California Department of Revenue is responsible for publishing the â The California state sales tax rate is currently.

Automating sales tax compliance can help your business keep compliant with changing. Jurisdiction 2021-22 2020-21 Net Increase Increase. Some cities and local governments in Sacramento County collect additional local sales taxes which can be as high as 25.

The current total local sales tax rate in Sacramento CA is 8750. 110 for each 1000. 1-916-274-3350 FAX 1-916-285-0134 wwwboecagov December 31 2020.

Calculating The Sacramento County Transfer Tax. The December 2020 total local sales tax rate was also 8750. PROPERTY TAX DEPARTMENT.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. The sales tax jurisdiction name is Sacramento Tmd Zone 1 which may refer to a local government division. 2020-2021 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified gob 01171 sacto unified gob 01171 sacto unified gob 01171.

The 2018 United States Supreme Court decision in South Dakota v. The median property tax on a 32420000 house is 239908 in California. Transfer tax can be assessed as a percentage of the propertys final sale price or simply a flat fee.

The Sacramento County Sales Tax is. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Learn all about Sacramento real estate tax.

If a tax bill remains unpaid after Oct. Tax Rate Areas Sacramento County 2021. Current Tax Rates Tax Rates Effective April 1 2021 Find a Sales and Use Tax Rate by Address Tax Rates by County and City Tax Rate Charts Tax Resources The following files are provided to download tax rates for California Cities and Counties.

Total City of Sac. Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025. 075 lower than the maximum sales tax in CA.

The Sacramento County Sales Tax is 025.

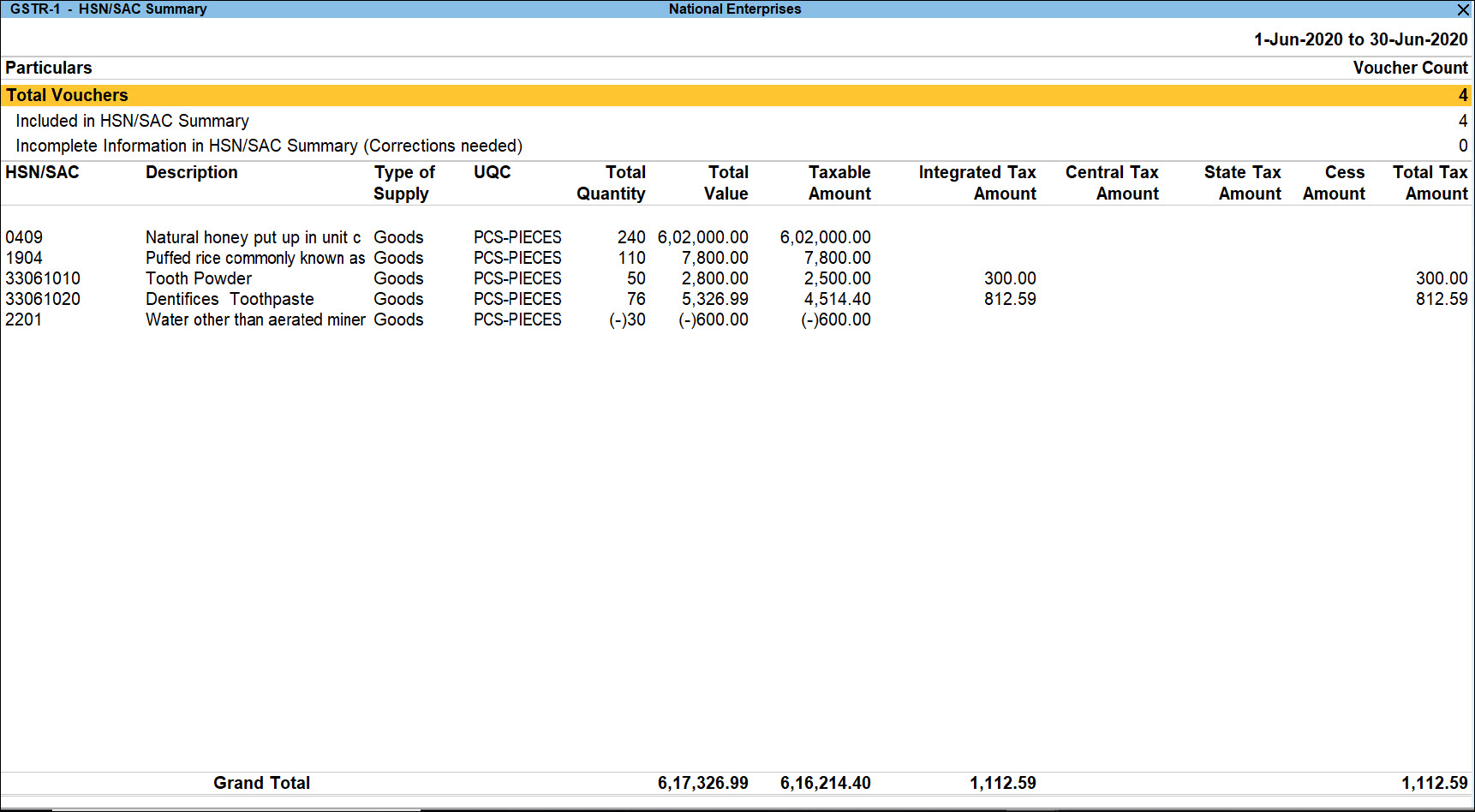

How To View Hsn Sac Summary Of Supplies In Tallyprime Tallyhelp

Sacramento County Property Tax Anderson Business Advisors

Map Of City Limits City Of Sacramento

Sacramento County Ca Property Tax Search And Records Propertyshark

Download 10 Gst Invoice Templates In Excel Exceldatapro Invoice Format In Excel Invoice Format Invoice Template

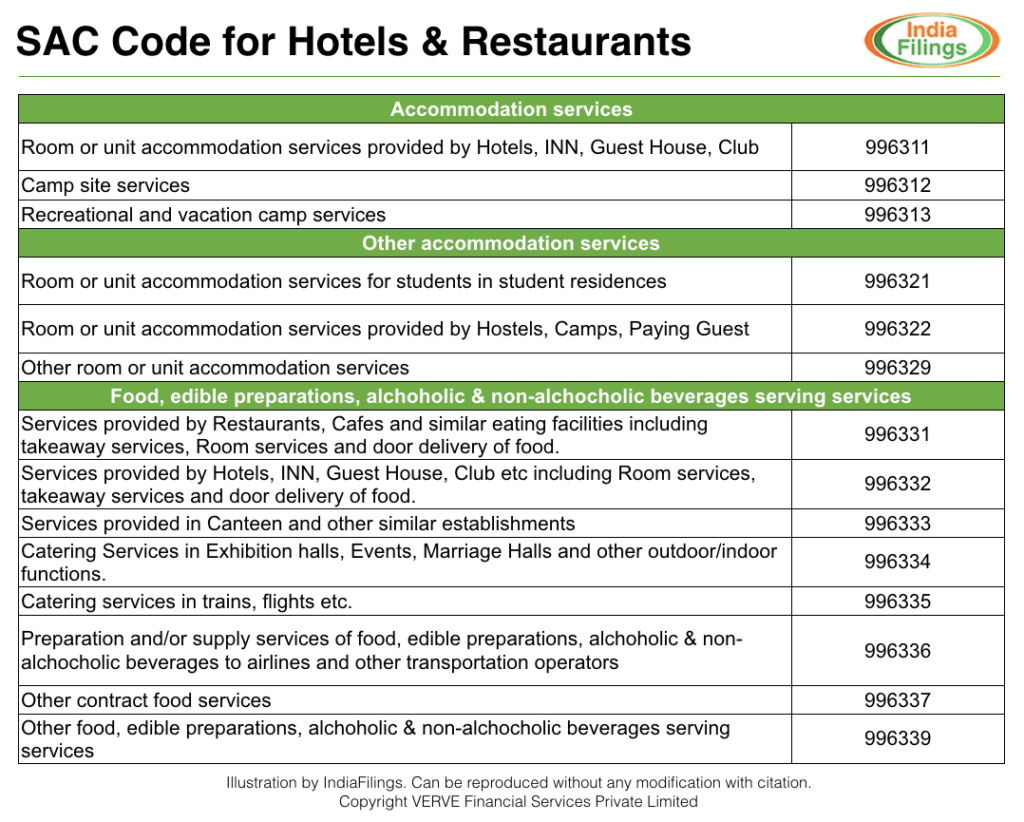

Gst On Hotels And Restaurants Indiafilings

Sacramento County Ca Property Tax Search And Records Propertyshark

Hollywood California Hollywood Attractions Universal Studios Hollywood Hollywood Walk California Map Lemoore California California Facts

Mandatory Hsn Sac Codes In Gst Invoices From 01 04 2021

Re Max Around The World Remax Selling House Town And Country

Gst On Rate And Sac Code On Painting Work Services 18 Check Now

Sacramento County Ca Property Tax Search And Records Propertyshark

Services Rates City Of Sacramento

Pin By Nathaniel Key On Real Estate In 2021 Boise City Sunnyvale Housing Market

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

Sacramento County Ca Property Tax Search And Records Propertyshark